-

Blog

Archives

Categories

-

Sign Up to Receive Our Newsletter

CategoryUncategorized Archives — C. Lynn Northrup, CPA, CPIM

Cannabis Cultivation Cost Management

June 17th, 2021

Tracking and managing the cost of growing cannabis is essential to maximize profitability. You are flying blind when the cost of growing cannabis isn’t matched with the yield harvested. Cost accounting can be confusing plus most cannabis business owners haven’t had the benefit of cost accounting training. Our objective is to explain, document, and clarify the steps required to develop good cannabis cost data.

Cannabis costs that should be tracked include:

- Labor required to grow and produce saleable product.

- Raw material including seeds, clones, and grow supplies.

- Grow equipment including lights and a hydro system.

- Cost of lighting.

- Packaging supplies.

These are direct costs and will be variable with growing and harvesting of cannabis products.

Direct costs of production results in more effective cost measurement. Inclusion of overhead costs using complicated allocation methods can produce misleading results. A direct cost approach captures just the variable costs of production and excludes selling expenses, office supplies, rent, marketing, and administrative costs. For the purpose of determining yearend inventory valuation allocation of overhead costs could be necessary depending on the valuation methodology that is used.

This direct cost approach should track the progress of production (grow) in specific units broken down into steps to match the cycle of the growing and harvesting process. Your grow schedule might look something like the following:

| Time Frame | Days | |

| Clones | n/a | – |

| Vegetative | 2 weeks | 14 |

| Flowering | 8 – 9 weeks | 64 |

| Harvest | 1 – 3 days | 3 |

| Curing | 1 – 2 weeks | 14 |

| Trimming Ready for Sale | 5 days | 5 |

| Total Days | 100 |

It is important to realize that plants in the cultivation process will have different maturity dates. Accordingly, tracking the progress of your production should be done using specific and consistent equivalent units of measure. In order to keep it simple, use an average yield per plant. Using this metric, you can convert your plants into equivalent units based on the stage of growth or percentage of maturity. Cultivation should be converted into equivalent and measurable units for the average yield per plant which can be used to measure your actual yield.

Assuming that one plant yields .5 pound in equivalent units at harvest maturity, this metric can be used to determine the expected yield for the entire cultivation. This is where you utilize the grow schedule to determine the number of plants at each stage of the grow process. Here’s is what it might look like:

| Plants | % of Completion | Equivalent units | Yield/ LBS. | |

| Clones | 10 | 0 | .5 | 0 |

| Vegetative | 30 | .25 | .5 | 3.75 |

| Flowering | 30 | .75 | .5 | 11.25 |

| Harvest | 30 | .90 | .5 | 18 |

| Curing | 30 | 1.0 | .5 | 15 |

| Trimming Ready for Sale | 30 | 1.0 | .5 | 15 |

| Total Current Yield | 60 | 78 |

If your total direct cost of per pound of yield is $1,000 then your existing inventory cost has a value of $78,000. This is an accurate way of tracking costs as it addresses only the costs of cultivation that are variable and excludes allocation of overhead.

Under ideal conditions, a cultivation can expect a yield of 500 grams or 17.5 oz. of marijuana per plant. This assumes that adequate space (6.5 feet), water, nutrients, and effective control of pests and diseases. Containers need to be 15 gallons in size for indoor cultivation.

This process can be utilized for keeping metrics on yield produced from your cultivation together with the direct controllable costs of production. The yield in pounds per plants and associated costs can provide a foundation for effective management and is one way to monitor efficiency of the cultivation.

According to the IRS pursuant to Treas. Reg. 1.471-11, cost of goods sold for producers includes direct material cost, e.g., marijuana seeds or plants; direct labor costs, e.g., planting, cultivating, harvesting, sorting; and indirect costs. Indirect costs may include repair expenses, maintenance, utilities, rent, indirect labor and production supervisory wages, indirect materials, tools, and cost of quality control.

Other Factors Impacting Yield

Light, nutrients, and genetics are all major factors that determine and affect cultivation yield.

Light can be measured in grams per watt providing an accurate measurement of production quantity as well as profitability. This measurement considers the amount of energy (watts) used to produce a gram of product. The higher the production output per watt, the greater efficiency that is produced. The calculation is determined by multiplying the total yield in grams times the total draw in watts to determine grams per watt. Square footage is also an important factor in determining efficiency and potential profitability. Therefore, yield per square foot is an important metric. It should be noted that some strains will yield varying amounts making it important to measure the yield per strain. Nutrients are another factor in determining yield and developing yield measurements compared to the cost of nutrients can help determine the most efficient combination to produce the best yield. Finding the best combination of yield measurement will be a process of experimenting to find the best combination of all the factors that produce the most efficient and profitable yield results.

Profit Margin and Breakeven

March 30th, 2021

Profit margin is equal to the net profit ratio of net profit to sales. This is calculated by dividing net profit by sales. Productivity is the rate of asset turnover which is determined by dividing sales by total assets. Profitability is then determined by multiplying profit margin by the rate of productivity.

There are five variables within the profit model that need to be understood. The first variable is the selling price of your product or service. The next consideration is the physical volume of sales that will include the mix of products or services sold. Variable cost of the product is the third factor that needs to be considered. The fourth variable are non-variable costs or fixed expenses. These four factors make up the composition of the profit and loss statement.

In addition to the variables of sales and associated costs and expenses is the amount of investment assets required to support the business. Finally, there is a 6th factor that needs to be considered which is the amount of risk and how the assets utilized in the business are financed.

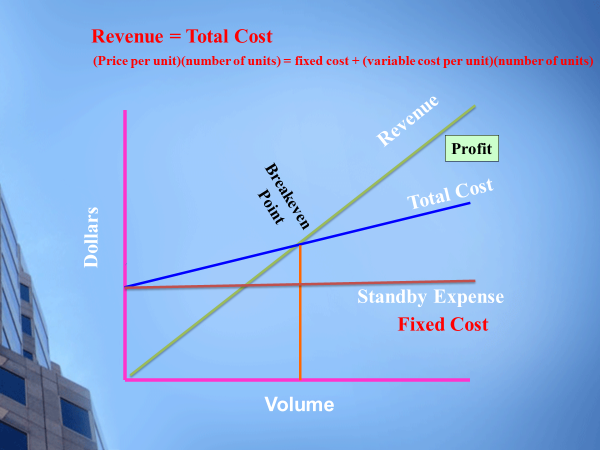

It’s important to understand these variables to effectively analyze and interpret profit and loss data. The breakeven point is a good way to get a handle on how the variables interact to improve your understanding of the profit and loss statement. When revenue equals total cost, it defines the breakeven point. The formula for calculating the breakeven point is the price per unit times the number of units which is equal to fixed costs plus variable cost per unit times the number of units.

Here is a graphic illustrating these concepts:

The breakeven concept helps put understanding managing, costs, pricing, and volume in the proper prospective.

Managing Inventory Turnover

February 10th, 2021

Efficient and effective inventory turnover is one of the secrets to improving cash flow and managing inventory investment. Businesses struggle with inventory management. Excess and obsolete inventories represent a major problem for most businesses, large or small. Effective inventory management and measurement is crucial.

First, inventory turnover is defined as the number of times turns over or cycles during the year. It is a measure of how well your inventory is working for you. The higher (or faster cycling) your inventory turns indicates a lower level of inventory investment and a more efficient leveraging of your investment to support your sales level.

Inventory turnover is a ratio of your average cost of sales to average cost of inventory. Cost of sales is used in order to compare inventory cost and not to company profit. Average inventory is a calculated number that should be based on the best possible assumption which is typically the sum of the extension of an item quantity times unit cost. I suggest using direct unit costs to avoid inclusion of allocated overhead.

The formula for the calculation is average cost of sales ÷ average inventory. When making this calculation the most accurate calculation is by using daily values and the next best option is to use monthly average costs and data. Using yearly averages provides least meaningful information.

Measurement should utilize data that includes cost of sales and inventory amounts broken down by product line. This shows what products are not selling so you adjust purchasing decisions or pricing decisions to correct the level of inventory investment.

Vendor relationships can be a major factor in managing inventory investments. This might involve the timing purchase orders or logistics with replenishment of stock. Your strategy might be to have vendors carry your inventory without impacting customer service. This is called vendor managed inventory. Personnel with purchasing responsibility need to understand the objectives for managing inventory investment and the optimum level of inventory by product, parts, or units.

If you can measure inventory turnover, you can more effectively manage it. This requires having the proper technology tools to perform accurate and timely measurement. Accurate sales forecasts combined with perpetual inventory management and customer relations management systems are critical.

Another tool is the ABC inventory approach, which splits inventory into three classes where A items are the highest priority and cost items (10 to 20 percent by number of items and 70 percent of dollar value) and receive more attention. Less focus and attention are given to B and C inventory items. This allows managers to place their focus on the higher dollar areas that matter the most. There are a number of other factors such as economic order quantities (EQO), lead times, inaccurate bills of material, and inaccurate yield quantities which can result in excess inventory.

My recommendation is to place emphasis on managing turnover and measuring it. Constant focus on inventory investment and turnover will produce awareness and lead to action that produce higher inventory turnover, increased cash flow, and reduced investment in inventory.

Planning for Success

January 27th, 2021

Planning for success will create success. The pandemic has challenged existing small businesses in addition to the startup of new businesses as a means of economic survival. Creating a business plan will help you:

- Think through your entire business strategy.

- Understand your financial requirements.

- Secure funding.

- Develop your marketing message.

- Identify key customers and how to provide them value.

- Recognize operational challenges.

The process of developing and documenting your business plan gives you a chance to make your mistakes on paper so you can avoid making them. This saves time, money, and costly mistakes.

Some things to consider in your planning process:

- Understand your customers and their needs to help position you to create value for them.

- Develop solutions that fit customer needs and solves their problems.

- Describe how your business works and how you deliver value to customers.

- Identify and analyze your main competitors so you can create a competitive advantage.

- Assess your target market to make sure it’s big enough to make you profitable.

- Analyze your financial projections and develop scenarios of what could happen.

- Make sure your value proposition is sustainable and scalable.

Creating a careful and complete business plan is a blue print for success.

Many new entrepreneurs will start out and not know where they can get help with information they need to get started. Here is information on some resources for small businesses that might be helpful.

- https://digital.com/how-to-take-your-small-business-online/

- https://digital.com/business-loans/

- https://digital.com/business-credit-cards/

Get started on planning for success today!

Cannabis Guidance and the IRS

January 19th, 2021

The IRS recently published guidance to provide cannabis businesses insight regarding compliance with IRS regulations. Major questions have been raised regarding Section 471 (c) which allows small business tax payers with revenue under $25 million to adopt the cash basis of accounting and prepare the books and records in accordance with the taxpayer’s accounting records. This seemed to open the door to modifying how cannabis businesses recorded cost of goods sold to minimize the impacted of Section 280E. Changes in Section 471 (c) resulted from the Tax Cuts and Jobs Act of 2018.

Section 280E disallows all deductions or credits for a business that sells or otherwise traffics marijuana. However, Section 280E does allow businesses to reduce its gross receipts by properly calculating cost of goods sold. This means that advertising or selling expenses are not deductible.

The guidance under Section 471 (c) according to the IRS is that it is just a timing provision and would not permit a taxpayer to recover a cost that it would not otherwise be permitted to recover or deduct for Federal income tax purposes solely by reason of it being an inventory cost. We’re not sure if this works and there could a conflict with Section 471 (c). This is a new regulation and is the IRS opinion on the application of Section 471 (c). They are adding Internal Revenue Code “flush language” via a regulation which is the opinion of the Internal Revenue Service.

I work with multiple cannabis businesses and have spent a considerable amount of time dealing with Section 471 (c) and how to apply it. The regulations say that qualifying businesses may choose to treat its inventory as reflected in the taxpayer’s books and records prepared in accordance with the taxpayer’s accounting procedures. If a change in accounting was made to adopt the new regulations, a Form 3115 is required to be filed outlining the changes.

A taxpayer taking the Section 471 (c) approach contrary to the regulations should consider disclosing any position that could be inconsistent with the new regulations. A disclosure should be made by filing a Form 8275R with the tax return. Determining cost of goods sold for cannabis businesses can be complicated and should be based on cost accounting logic. Cannabis businesses and their tax advisors should consult with someone experienced in these areas when applying these regulations.

IRS guidance has indicated that the growth of the marijuana industry will warrant increased tax compliance efforts. Accordingly, extreme care should be taken when developing and preparing cannabis tax returns based on the recent IRS guidance.

How to Survive the Pandemic

January 2nd, 2021

The pandemic has stressed and challenged businesses to the limit. Survival is a real question, asking many, can we make it? These unusual times call for steps and actions where most business owners and their CPA advisors have no experience.

Assess for Areas of Pain

The first step is assessing the business and identifying the biggest areas of pain. Then quick action is needed to address the most critical areas and take action to stop the bleeding. I call this moving from crisis to stabilization. You can’t survive without cash flow so this needs to be a top priority.

Do everything to keep your creditors and lenders comfortable and share with them your plans to stabilize the business. Give them full respect and attention together with up to date information on collateral.

Creating Cash Flow

Creating cash is pulling cash from your balance sheet and the balance sheets of your customers and vendors. The cash you generate in this way will help to fund the stabilization of your business.

Analyze your cash flows and take the steps needed to stabilize and generate as much cash as possible. The obvious steps include applying for SBA loans and Payroll Protection Program loans. Do everything possible to generate sales and keep key customers. Exploit every opportunity to create cash and address the biggest cash drain areas and plug those leaks as fast as possible.

Analyze Your P&L Statement

You then need to look at your profit and loss statement to identify the problems and opportunities to eliminate cash drains or reduce their impact. Declining sales is the most obvious issue. The next question is what is your gross profit margin? Benchmark it to your industry and business model. A lower gross profit margin means that you’re either not charging enough or your business processes are inefficient. You may need to increase prices or improve your business processes or both.

The next area is overhead and how much can you reduce it. The biggest areas will be payroll, insurances, facilities, and interest. You probably need to address all these areas.

Once you stabilize sales, you need to determine a business structure that can support a lower level of revenue. If revenue is cut in half, how do you adapt? How do you reorganize your business around that new reality? Make a conservative guess on revenue and build a plan to become profitable at that reduced level. Forecast cash flows and find ways to stay cash positive.

Create a Survival Plan

Create a survival plan and then sell it to lenders, vendors, employees, and key customers. This is a better option that going through a liquidation. Keep your plan simple and straight forward.

When going through this process, it is essential to move quickly. Do as much as possible as fast as you can. These should include layoffs, reduced or closed operations, and charging higher prices. Get all this done and then focus on recovery.

During the recovery, concentrate on rebuilding confidence and morale. Restructure your debts around the newly reorganized business. Try to stretch out the debt or in extreme cases, see if your lender would be willing to reduce the amount of loan balance.

Once you have restructured your business, you’ll have a more positive framework from which to grow the business with new strategies and ideas. By taking these steps, you’ll be positioned to take advantage of new growth opportunities and increase profits going forward as the pandemic subsides and we reach a new normal.

© C. Lynn Northrup, CPA, CPIM

Urgency Creates Change

January 2nd, 2020

Change starts with a sense of true urgency and in most cases needs to be created to make things happen. The enemy of urgency is complacency. Complacent people don’t look for new opportunities and they pay more attention to their internal feelings than external feelings. They tend to move slow when they need to move fast. What ever worked in the past is what guides them.

While anxiety and fear can drive behavior that might be mistaken for urgency, the resulting actions tend to be non-productive. This is called false urgency resulting from failure. The thought process from a sense of false urgency usually is not productive and proactive. It typically is mindless wheel spinning that creates no positive results.

A true sense of urgency is created and recreated by communicating the existence of great opportunities together with the existing hazards and roadblocks. People engaged in a true sense of urgency exhibit a strong need to move and win, now. The biggest challenge about creating a sense of urgency is taking the first step in initiating the action needed to succeed in a changing world. Real urgency isn’t a natural state of affairs because it needs to continually be created to get change initiatives moving and in the right direction. In a constantly changing world, the good news is that there are an over abundant number of opportunities that can be utilized to create true urgencies.

A true sense of urgency evolves from a set of feelings that creates a compulsive determination to move right now. True urgency is a process of winning the hearts and minds of the people needed to make change happen. Mindless emotion doesn’t get the job done. Winning change strategies utilize sound, ambitious, but logical goals using methods allowing people to experience the feelings that embrace the determination needed to make things happen.

The strategy for producing a true sense of urgency focuses on creating very alert, visibly oriented action, aimed at winning with daily progress toward achieving the vision and goals targeted at core emotional feelings. Here are the four tactics needed to make this strategy successful:

- Reconnect internal reality with external opportunities and obstacles using data, people, video, and other media.

- Avoid acting anxious or angry and always effectively demonstrate your own sense of urgency in meetings, one-on-one interactions and other communication with the people engaged in the change process.

- Take the opportunity to determine if crises can be used to your advantage and always proceed with caution.

- Remove the negative and urgency skeptics and keep the group complacent to avoid destructive negative urgency.

In addition to these four tactics is the necessity of keeping up the pressure to maintain a sense of continued urgency. The trap that can occur is achieving success and then losing your momentum of continuous improvement. Short-term success does not always translate to long-term results.

Here are some thoughts on maintaining urgency after making a successful change. Always be on the alert for potential declines in the sense of urgency. Realize that complacency can set in so be ready with backup solutions to maintain momentum. Take advantage of new developments to apply to change initiatives and improvements. Essentially, building a culture acting with a high sense of urgency will focus on the strategy for producing a true sense of urgency and application of the four tactics that are needed to make a positive change become a constant.

Effective Problem Solving and Decision-Making

December 13th, 2019

Solving problems and making decisions go hand in hand. Here’s some tips on how to do a better job of defining problems and how to make good decisions on effective solutions. First, let’s address problem solving.

Here are the three steps to solving problems. First, clearly identify the problem. Second, clarify the problem, and then find the cause. The process of thinking or solving a problem only happens after you have captured and fully understand the problem. The biggest hurdle in solving problems is thinking you know everything and that nothing needs to be changed.

Since “perception is 9/10ths of the law,” there is a tendency to base decisions and actions on what’s perceived to be true. The key to diagnosing problems is separating truth from what seems to be true. Don’t jump to conclusions.

Learn to think out of the box and master the obvious. Look for potential mental blind spots and avoid them. Sort out the facts, avoid ambiguous and vague descriptions and don’t act on assumptions.

Here’s a diagnostic approach to dealing with problems:

- Who?

- What?

- When?

- Where?

- Why?

- And how?

Other steps should include this five-step process:

- Define the problem.

- Clarify your objectives.

- Develop creative alternatives.

- Consider the consequences.

- Analyze the trade-offs.

Defining the parameters of a problem is essential. Dig into the issues and make sure that you’re focusing on the right things. Be flexible and evaluate all the parameters and be willing to shift based on changing circumstances.

Problems need to be captured, developed, examined, and then given a shape. Try to understand the magnitude of what you don’t know. The current reality of the situation is easy to miss, avoid, or ignore.

A key step in solving problems is carefully examining the details and writing them down. This helps to clarify uncertainty. Writing down the problem creates conciseness, accuracy, and gives you a better understanding of the problem.

Following this process helps clarify what you know, what you don’t know, and what you are trying to find out. It helps you separate problems from the details so you can better understand the nature and scope of the real problem.

Clarification lets you evaluate the size and gravity of a problem and puts you on a fast track toward finding a solution. From this point, you can address increasing productivity, improving quality, doing things faster, and reducing costs.

The next and most important step in the process is taking action to implement the solutions. Don’t procrastinate! Just act and implement the solution. Just think about how much time is wasted by thinking and talking about what we are going to do. Just doing it saves a lot of time and produces more results.

Helping Small Businesses Succeed

July 9th, 2019

Small business owners need help managing their business. They are challenged daily with complex issues and decisions that significantly impact their profits. Having an experienced and skilled advisor help them make decisions increases profitability.

Too many CPAs are comfortable just doing the tax return. Success requires constant monitoring so key concepts and ideas are considered and not overlooked. In addition, clients get wrapped up in day to day details and frequently don’t stop to capture the big picture.

Helping small business succeed is an on-going process of education and providing them with a blueprint for success. CPAs and advisors need to be proactively engaged in raising questions and listening. This produces an action-oriented environment to identify the issues and develop effective solutions. It provides what I call, a road map to success.

The road map to success focuses on profitability and building business value. It is an approach that applies a blend of financial and non-financial measurements to make sure results are on track. It is a process of continuous assessment of the business and triggers action and produces results. A primary tool that I use with clients is a rolling forecast of financial results that considers actual results combined with our best estimate of future results. This gives a view of profitability in addition to expected cash flows.

I conduct monthly meetings to review results and go over the rolling forecast. This enables evaluation of business plans and strategies allowing for an effective and profitable business process. It also sets the stage for problem identification and implementation of solutions. From here, we create a Journey to Results with a road map to achievement.

The road map gives clients an approach to focus on their business. We can scope out what needs to be done and address the reality of economic and market conditions. Products and services are optimized and allows business owners to get the most bang for their buck.

This coaching or advisory process is what I provide to every client. It works, so why not give it a try and see what your business can achieve.

Building Business Success

March 27th, 2018

Building success in business and in life requires five essential ingredients. First, you need a vision of where you want to go and what you want to accomplish. Then you need to establish goals and objectives, otherwise you’re just wandering aimlessly with no direction. Goals and objectives form the foundation for action plans and steps that are needed. Finally, you need to measure your progress. It seems simple, but amazingly many businesses don’t follow these steps.

I have coached and taught the tools and techniques needed to achieve business success to hundreds of businesses and thousands of students over the years. Now these tools and techniques have been combined into affordable self-paced programs. The programs include Creating Success, Accounting Basics, Basics of Business Financial Management, and Basic Business Skills.

In addition, I created the Boot Camp for Small Business to establish a foundation for small businesses to grow and increase their value. These self-paced training programs provide the secrets to building business success and provide a roadmap to start a journey to results. The Boot Camp says that when you get the strategy right, the profit will follow. When there is profit potential – there is access to capital.

Accounting is the language of business. Business success is dependent on accounting. Accounting Basics teaches business how to measure results, how to analyze business transactions, and manage cash flow. It also spells out the techniques for budgeting and planning, how to understand profit and loss statements, and how to read balance sheets.

The Basics of Business Financial Management focuses on how to use financial reporting tools. Students learn how to manage debt, management of cash flow, and how to create a budget. The training program provides all the steps needed to create financial plans and forecast financial results.

The Basic Business Skills training program provides the tools needed to grow your business. Businesses learn how to sell and market their products including the techniques of pricing. The essentials of business law are spelled out. Business operations and the basics of managing inventory are also included in the program. This program helps businesses achieve success, maximize profits, and cash flow.

These training programs provide the secrets to building business success. The Boot Camp provides the following essentials:

- Attract more customers

- Get them to come back more often

- Get them to spend more each time

- Get them to recommend you to their friends

Sadly, very few businesses have a strategy focused on these growth steps.

Businesses and individuals can benefit from the knowledge provided by these programs. That’s why I created them.