-

Blog

Archives

Categories

-

Sign Up to Receive Our Newsletter

Profit Margin and Breakeven

March 30th, 2021

Profit margin is equal to the net profit ratio of net profit to sales. This is calculated by dividing net profit by sales. Productivity is the rate of asset turnover which is determined by dividing sales by total assets. Profitability is then determined by multiplying profit margin by the rate of productivity.

There are five variables within the profit model that need to be understood. The first variable is the selling price of your product or service. The next consideration is the physical volume of sales that will include the mix of products or services sold. Variable cost of the product is the third factor that needs to be considered. The fourth variable are non-variable costs or fixed expenses. These four factors make up the composition of the profit and loss statement.

In addition to the variables of sales and associated costs and expenses is the amount of investment assets required to support the business. Finally, there is a 6th factor that needs to be considered which is the amount of risk and how the assets utilized in the business are financed.

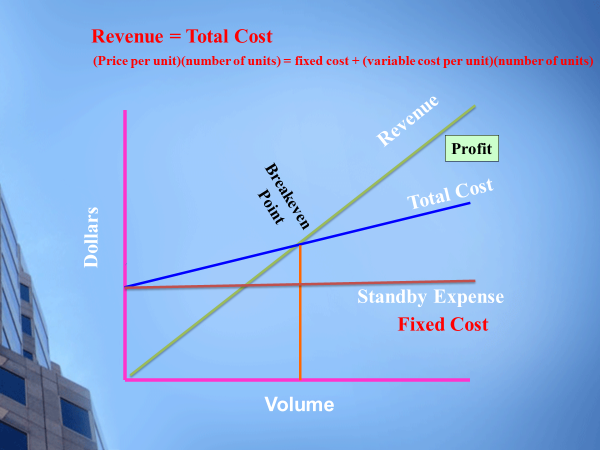

It’s important to understand these variables to effectively analyze and interpret profit and loss data. The breakeven point is a good way to get a handle on how the variables interact to improve your understanding of the profit and loss statement. When revenue equals total cost, it defines the breakeven point. The formula for calculating the breakeven point is the price per unit times the number of units which is equal to fixed costs plus variable cost per unit times the number of units.

Here is a graphic illustrating these concepts:

The breakeven concept helps put understanding managing, costs, pricing, and volume in the proper prospective.