-

Blog

Archives

Categories

-

Sign Up to Receive Our Newsletter

C. Lynn Northrup, CPA, CPIM

Cannabis Cultivation Cost Management

June 17th, 2021

Tracking and managing the cost of growing cannabis is essential to maximize profitability. You are flying blind when the cost of growing cannabis isn’t matched with the yield harvested. Cost accounting can be confusing plus most cannabis business owners haven’t had the benefit of cost accounting training. Our objective is to explain, document, and clarify the steps required to develop good cannabis cost data.

Cannabis costs that should be tracked include:

- Labor required to grow and produce saleable product.

- Raw material including seeds, clones, and grow supplies.

- Grow equipment including lights and a hydro system.

- Cost of lighting.

- Packaging supplies.

These are direct costs and will be variable with growing and harvesting of cannabis products.

Direct costs of production results in more effective cost measurement. Inclusion of overhead costs using complicated allocation methods can produce misleading results. A direct cost approach captures just the variable costs of production and excludes selling expenses, office supplies, rent, marketing, and administrative costs. For the purpose of determining yearend inventory valuation allocation of overhead costs could be necessary depending on the valuation methodology that is used.

This direct cost approach should track the progress of production (grow) in specific units broken down into steps to match the cycle of the growing and harvesting process. Your grow schedule might look something like the following:

| Time Frame | Days | |

| Clones | n/a | – |

| Vegetative | 2 weeks | 14 |

| Flowering | 8 – 9 weeks | 64 |

| Harvest | 1 – 3 days | 3 |

| Curing | 1 – 2 weeks | 14 |

| Trimming Ready for Sale | 5 days | 5 |

| Total Days | 100 |

It is important to realize that plants in the cultivation process will have different maturity dates. Accordingly, tracking the progress of your production should be done using specific and consistent equivalent units of measure. In order to keep it simple, use an average yield per plant. Using this metric, you can convert your plants into equivalent units based on the stage of growth or percentage of maturity. Cultivation should be converted into equivalent and measurable units for the average yield per plant which can be used to measure your actual yield.

Assuming that one plant yields .5 pound in equivalent units at harvest maturity, this metric can be used to determine the expected yield for the entire cultivation. This is where you utilize the grow schedule to determine the number of plants at each stage of the grow process. Here’s is what it might look like:

| Plants | % of Completion | Equivalent units | Yield/ LBS. | |

| Clones | 10 | 0 | .5 | 0 |

| Vegetative | 30 | .25 | .5 | 3.75 |

| Flowering | 30 | .75 | .5 | 11.25 |

| Harvest | 30 | .90 | .5 | 18 |

| Curing | 30 | 1.0 | .5 | 15 |

| Trimming Ready for Sale | 30 | 1.0 | .5 | 15 |

| Total Current Yield | 60 | 78 |

If your total direct cost of per pound of yield is $1,000 then your existing inventory cost has a value of $78,000. This is an accurate way of tracking costs as it addresses only the costs of cultivation that are variable and excludes allocation of overhead.

Under ideal conditions, a cultivation can expect a yield of 500 grams or 17.5 oz. of marijuana per plant. This assumes that adequate space (6.5 feet), water, nutrients, and effective control of pests and diseases. Containers need to be 15 gallons in size for indoor cultivation.

This process can be utilized for keeping metrics on yield produced from your cultivation together with the direct controllable costs of production. The yield in pounds per plants and associated costs can provide a foundation for effective management and is one way to monitor efficiency of the cultivation.

According to the IRS pursuant to Treas. Reg. 1.471-11, cost of goods sold for producers includes direct material cost, e.g., marijuana seeds or plants; direct labor costs, e.g., planting, cultivating, harvesting, sorting; and indirect costs. Indirect costs may include repair expenses, maintenance, utilities, rent, indirect labor and production supervisory wages, indirect materials, tools, and cost of quality control.

Other Factors Impacting Yield

Light, nutrients, and genetics are all major factors that determine and affect cultivation yield.

Light can be measured in grams per watt providing an accurate measurement of production quantity as well as profitability. This measurement considers the amount of energy (watts) used to produce a gram of product. The higher the production output per watt, the greater efficiency that is produced. The calculation is determined by multiplying the total yield in grams times the total draw in watts to determine grams per watt. Square footage is also an important factor in determining efficiency and potential profitability. Therefore, yield per square foot is an important metric. It should be noted that some strains will yield varying amounts making it important to measure the yield per strain. Nutrients are another factor in determining yield and developing yield measurements compared to the cost of nutrients can help determine the most efficient combination to produce the best yield. Finding the best combination of yield measurement will be a process of experimenting to find the best combination of all the factors that produce the most efficient and profitable yield results.

Profit Margin and Breakeven

March 30th, 2021

Profit margin is equal to the net profit ratio of net profit to sales. This is calculated by dividing net profit by sales. Productivity is the rate of asset turnover which is determined by dividing sales by total assets. Profitability is then determined by multiplying profit margin by the rate of productivity.

There are five variables within the profit model that need to be understood. The first variable is the selling price of your product or service. The next consideration is the physical volume of sales that will include the mix of products or services sold. Variable cost of the product is the third factor that needs to be considered. The fourth variable are non-variable costs or fixed expenses. These four factors make up the composition of the profit and loss statement.

In addition to the variables of sales and associated costs and expenses is the amount of investment assets required to support the business. Finally, there is a 6th factor that needs to be considered which is the amount of risk and how the assets utilized in the business are financed.

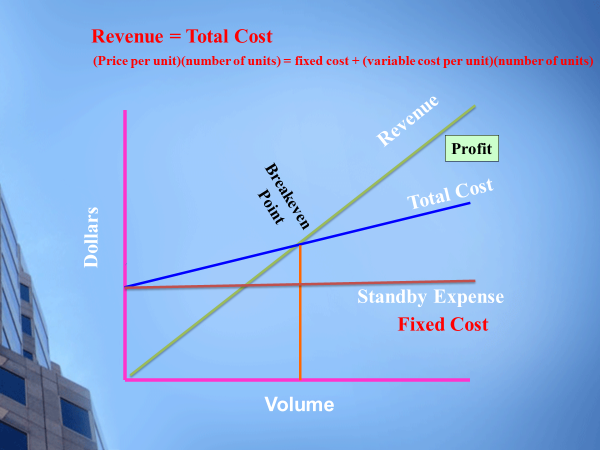

It’s important to understand these variables to effectively analyze and interpret profit and loss data. The breakeven point is a good way to get a handle on how the variables interact to improve your understanding of the profit and loss statement. When revenue equals total cost, it defines the breakeven point. The formula for calculating the breakeven point is the price per unit times the number of units which is equal to fixed costs plus variable cost per unit times the number of units.

Here is a graphic illustrating these concepts:

The breakeven concept helps put understanding managing, costs, pricing, and volume in the proper prospective.

Managing Inventory Turnover

February 10th, 2021

Efficient and effective inventory turnover is one of the secrets to improving cash flow and managing inventory investment. Businesses struggle with inventory management. Excess and obsolete inventories represent a major problem for most businesses, large or small. Effective inventory management and measurement is crucial.

First, inventory turnover is defined as the number of times turns over or cycles during the year. It is a measure of how well your inventory is working for you. The higher (or faster cycling) your inventory turns indicates a lower level of inventory investment and a more efficient leveraging of your investment to support your sales level.

Inventory turnover is a ratio of your average cost of sales to average cost of inventory. Cost of sales is used in order to compare inventory cost and not to company profit. Average inventory is a calculated number that should be based on the best possible assumption which is typically the sum of the extension of an item quantity times unit cost. I suggest using direct unit costs to avoid inclusion of allocated overhead.

The formula for the calculation is average cost of sales ÷ average inventory. When making this calculation the most accurate calculation is by using daily values and the next best option is to use monthly average costs and data. Using yearly averages provides least meaningful information.

Measurement should utilize data that includes cost of sales and inventory amounts broken down by product line. This shows what products are not selling so you adjust purchasing decisions or pricing decisions to correct the level of inventory investment.

Vendor relationships can be a major factor in managing inventory investments. This might involve the timing purchase orders or logistics with replenishment of stock. Your strategy might be to have vendors carry your inventory without impacting customer service. This is called vendor managed inventory. Personnel with purchasing responsibility need to understand the objectives for managing inventory investment and the optimum level of inventory by product, parts, or units.

If you can measure inventory turnover, you can more effectively manage it. This requires having the proper technology tools to perform accurate and timely measurement. Accurate sales forecasts combined with perpetual inventory management and customer relations management systems are critical.

Another tool is the ABC inventory approach, which splits inventory into three classes where A items are the highest priority and cost items (10 to 20 percent by number of items and 70 percent of dollar value) and receive more attention. Less focus and attention are given to B and C inventory items. This allows managers to place their focus on the higher dollar areas that matter the most. There are a number of other factors such as economic order quantities (EQO), lead times, inaccurate bills of material, and inaccurate yield quantities which can result in excess inventory.

My recommendation is to place emphasis on managing turnover and measuring it. Constant focus on inventory investment and turnover will produce awareness and lead to action that produce higher inventory turnover, increased cash flow, and reduced investment in inventory.

Managing Cannabis Inventories

February 3rd, 2021

Managing and valuing inventories in cannabusinesses is the key to increasing cash flow and lowering taxes. Cannabusinesses are restricted to reducing gross revenues by the cost of goods sold because of IRS Section 280E. Section 280E was enacted in 1982 and provides that no deduction or credit is allowed for any amount paid or incurred in carrying on a trade or business consisting of the trafficking in controlled substances within the meaning of schedule I or II of the Controlled Substances Act. The only way cannabusinesses can reduce their tax burden is by maximizing cost of goods sold (COGS).

The tax laws and regulation associated with cannabusiness are complex. Understanding these complex laws and regulations makes the job of valuing inventories and determining COGS of cannabis businesses a challenge. This is compounded by the cannabis industry being a collection of complex processes and types of businesses.

Cannabusinesses include cultivators or growers that grow plants and then harvest the flower from these plants. In addition to selling flower, it can also be processed into a variety of marijuana infused products (MIPs). Marijuana infused products are created by extracting distillate which is then infused into other cannabis products such as vape cartridges, edibles, topicals, wax, and shatter. These products are then packaged and sold through dispensaries. The tax laws and regulations for determining COGS and inventory valuation for growers and MIPs are different for dispensaries.

Cultivation or farming of cannabis needs to track the flower yield from indoor and outdoor grows measured in grams to develop a cost for the harvested flower. Marijuana infused products are the result of process manufacturing operations creating multiple varieties of products requiring different types of packaging. Costs are developed based on the recipes for these products, including packaging.

These products are then sold and distributed to dispensaries for ultimate resale to the consumer. Dispensaries, in many cases, are required to inspect, repackage, and check the quality of products before they can be sold to the consumer.

Most cannabis businesses are using Quick Books to accumulate costs supplemented by spreadsheets to calculate yield and the cost of distillate. The costs of cultivation and marijuana infused products include direct labor, material, and allocation of overhead. Allocation of overhead should be based on guidance from Section 471 and Section 263A of the Internal Revenue Code. It is critical to determine any allocation of overhead to be included in COGS in compliance with IRS codes and regulation, but also to maximize costs that offset gross revenue.

Accounting for cannabis products needs to be accurate. In some cases, ERP (Enterprise Resource Planning) systems are being utilized by larger operations. Dispensaries determine cost based on the actual cost of products purchased and associated freight. Inventory tracking is required, and many dispensaries utilize point of sale systems and inventory management systems to control and manage activity.

Based on my experience, managing and controlling inventory costs and the associated investment is one of the most challenging and critical areas of cannabusiness. First, inventory investment requires a significant cash investment. This makes effective purchasing and inventory management vital. Second, accurate and maximum determination of COGS reduces the tax burden created by IRS Section 280E. This means that inventory costing and management should be a top priority for all cannabusinesses and their accountants.

Utilization of professionals who understand cost accounting and the unique taxation requirements of the cannabis industry represents the key component to success or failure.

Planning for Success

January 27th, 2021

Planning for success will create success. The pandemic has challenged existing small businesses in addition to the startup of new businesses as a means of economic survival. Creating a business plan will help you:

- Think through your entire business strategy.

- Understand your financial requirements.

- Secure funding.

- Develop your marketing message.

- Identify key customers and how to provide them value.

- Recognize operational challenges.

The process of developing and documenting your business plan gives you a chance to make your mistakes on paper so you can avoid making them. This saves time, money, and costly mistakes.

Some things to consider in your planning process:

- Understand your customers and their needs to help position you to create value for them.

- Develop solutions that fit customer needs and solves their problems.

- Describe how your business works and how you deliver value to customers.

- Identify and analyze your main competitors so you can create a competitive advantage.

- Assess your target market to make sure it’s big enough to make you profitable.

- Analyze your financial projections and develop scenarios of what could happen.

- Make sure your value proposition is sustainable and scalable.

Creating a careful and complete business plan is a blue print for success.

Many new entrepreneurs will start out and not know where they can get help with information they need to get started. Here is information on some resources for small businesses that might be helpful.

- https://digital.com/how-to-take-your-small-business-online/

- https://digital.com/business-loans/

- https://digital.com/business-credit-cards/

Get started on planning for success today!

Cannabis Guidance and the IRS

January 19th, 2021

The IRS recently published guidance to provide cannabis businesses insight regarding compliance with IRS regulations. Major questions have been raised regarding Section 471 (c) which allows small business tax payers with revenue under $25 million to adopt the cash basis of accounting and prepare the books and records in accordance with the taxpayer’s accounting records. This seemed to open the door to modifying how cannabis businesses recorded cost of goods sold to minimize the impacted of Section 280E. Changes in Section 471 (c) resulted from the Tax Cuts and Jobs Act of 2018.

Section 280E disallows all deductions or credits for a business that sells or otherwise traffics marijuana. However, Section 280E does allow businesses to reduce its gross receipts by properly calculating cost of goods sold. This means that advertising or selling expenses are not deductible.

The guidance under Section 471 (c) according to the IRS is that it is just a timing provision and would not permit a taxpayer to recover a cost that it would not otherwise be permitted to recover or deduct for Federal income tax purposes solely by reason of it being an inventory cost. We’re not sure if this works and there could a conflict with Section 471 (c). This is a new regulation and is the IRS opinion on the application of Section 471 (c). They are adding Internal Revenue Code “flush language” via a regulation which is the opinion of the Internal Revenue Service.

I work with multiple cannabis businesses and have spent a considerable amount of time dealing with Section 471 (c) and how to apply it. The regulations say that qualifying businesses may choose to treat its inventory as reflected in the taxpayer’s books and records prepared in accordance with the taxpayer’s accounting procedures. If a change in accounting was made to adopt the new regulations, a Form 3115 is required to be filed outlining the changes.

A taxpayer taking the Section 471 (c) approach contrary to the regulations should consider disclosing any position that could be inconsistent with the new regulations. A disclosure should be made by filing a Form 8275R with the tax return. Determining cost of goods sold for cannabis businesses can be complicated and should be based on cost accounting logic. Cannabis businesses and their tax advisors should consult with someone experienced in these areas when applying these regulations.

IRS guidance has indicated that the growth of the marijuana industry will warrant increased tax compliance efforts. Accordingly, extreme care should be taken when developing and preparing cannabis tax returns based on the recent IRS guidance.

What is Strategic Planning?

January 12th, 2021

Everyone talks about doing strategic planning, but how many really understand it. I think it is simple and can be in three steps:

- Where are we?

- Where do we want to be?

- How do we get there?

How many businesses really take the time to stop and address these questions? Many organizations just go from day to day and never dig into the real issues raised by these three questions.

Strategic planning isn’t easy, but the payoff can be huge. It can alert organizations to opportunities in addition to challenges that lie ahead. We operate in a complex and rapidly changing world and gaining insight into the future can make the difference between success or failure. It can help avoid trouble or help to maintain control during a period of rapid change.

Assessing where we are involves looking at financial history, marketing, competition, problems, and opportunities. Pulling all this information together is hard work to create a foundation for planning.

Where do we want to be provides the results for visioning, innovation, and looking beyond right now. I think visons are the result of dreams of where we want to be. We then need to convert them into measurable goals and objectives. This can include profit and sales targets, market share, and ideas for new products and businesses.

We create strategies into how we get where we want to go. This is the nitty gritty of how we accomplish goals and setting new directions to take us into the future. Strategies can include some old established ideas in addition to new concepts that are completely out of the box. The planning process will detail the costs, resources, projected results, and a timeline for meeting our objectives.

The result of our planning boils down to what we need to do today to make the future be what we want it to be.

How to Survive the Pandemic

January 2nd, 2021

The pandemic has stressed and challenged businesses to the limit. Survival is a real question, asking many, can we make it? These unusual times call for steps and actions where most business owners and their CPA advisors have no experience.

Assess for Areas of Pain

The first step is assessing the business and identifying the biggest areas of pain. Then quick action is needed to address the most critical areas and take action to stop the bleeding. I call this moving from crisis to stabilization. You can’t survive without cash flow so this needs to be a top priority.

Do everything to keep your creditors and lenders comfortable and share with them your plans to stabilize the business. Give them full respect and attention together with up to date information on collateral.

Creating Cash Flow

Creating cash is pulling cash from your balance sheet and the balance sheets of your customers and vendors. The cash you generate in this way will help to fund the stabilization of your business.

Analyze your cash flows and take the steps needed to stabilize and generate as much cash as possible. The obvious steps include applying for SBA loans and Payroll Protection Program loans. Do everything possible to generate sales and keep key customers. Exploit every opportunity to create cash and address the biggest cash drain areas and plug those leaks as fast as possible.

Analyze Your P&L Statement

You then need to look at your profit and loss statement to identify the problems and opportunities to eliminate cash drains or reduce their impact. Declining sales is the most obvious issue. The next question is what is your gross profit margin? Benchmark it to your industry and business model. A lower gross profit margin means that you’re either not charging enough or your business processes are inefficient. You may need to increase prices or improve your business processes or both.

The next area is overhead and how much can you reduce it. The biggest areas will be payroll, insurances, facilities, and interest. You probably need to address all these areas.

Once you stabilize sales, you need to determine a business structure that can support a lower level of revenue. If revenue is cut in half, how do you adapt? How do you reorganize your business around that new reality? Make a conservative guess on revenue and build a plan to become profitable at that reduced level. Forecast cash flows and find ways to stay cash positive.

Create a Survival Plan

Create a survival plan and then sell it to lenders, vendors, employees, and key customers. This is a better option that going through a liquidation. Keep your plan simple and straight forward.

When going through this process, it is essential to move quickly. Do as much as possible as fast as you can. These should include layoffs, reduced or closed operations, and charging higher prices. Get all this done and then focus on recovery.

During the recovery, concentrate on rebuilding confidence and morale. Restructure your debts around the newly reorganized business. Try to stretch out the debt or in extreme cases, see if your lender would be willing to reduce the amount of loan balance.

Once you have restructured your business, you’ll have a more positive framework from which to grow the business with new strategies and ideas. By taking these steps, you’ll be positioned to take advantage of new growth opportunities and increase profits going forward as the pandemic subsides and we reach a new normal.

© C. Lynn Northrup, CPA, CPIM

Take this Time to Work on Your Business

April 6th, 2020

We’re facing the biggest challenge we’ve ever faced in our country and the world. Millions of people are without jobs and many businesses have been forced to shut down. We’re dealing with the Corona Virus crisis, the silent killer sweeping the country and the world. People are asking what we should do and how can we survive. I don’t the answers to the future. My advice is rather than panicking, take this time to work on your business and prepare for a future after the crisis.

Working on our business, what does that mean? Here’s what I think it means and some ideas on what we should be doing:

- Brainstorming for new ideas

- Assess your strategies and adjust for the future as best you can

- Evaluate and assess all the new risks

- Figure out how much money you will need to survive and ways to access it

- It’s essential to orient your business to the reality of new economic and market conditions

- Consider how to maximize assets to get the most bang for the buck

- How can the stimulus package be used to maximize your cash flow?

- Think about managing the scale of your business to fit and adjust to the future reality

This list could continue, but this gives you some thoughts and ideas on where to start working and focusing.

In addition to these ideas and thoughts, it’s essential to realize that there are only 4 ways to grow your business:

- Increase the number of customers of the type you want

- Increase the frequency of the transactions

- Increase the average value of each sale

- Increase the effectiveness of each business process

It all really boils down to these 4 ways and they need to be quantified in order to create focus on the right steps. Remember that what you can measure, you can manage, and produce the result as a result creating effective processes.

So, in the mist of all the fear and chaos, take the time to contemplate and consider different scenarios. Both the good and the bad. Plan for the worst and plan for the best. This will put you a better position to act and do what needs to be done.

Understanding Business Entity Structures

January 9th, 2020

It is important to understand that there are different entity (organizational) structures for conducting business. The form or type of organization will depend on the business purpose, a structure to provide legal protection, the size of the business, and the ease and cost to create the business organization.

Here are the common types of business organizations:

- Sole proprietorship

- Partnership

- Limited Liability Partnership

- S Corporation

- C Corporation

Each of these business organizations are described to provide background and understanding.

The Sole Proprietorship is the most common and easiest from of business organization to create. Typically, it is created by a person wanting to start a business out of their house or garage. The sole proprietor invests in their business, usually from their own savings, and begins operations. The type of business might be a service business, a small craft, or a distribution business. It also might involve an internet based business selling products, conducting affiliate marketing, and utilizing social media techniques.

A simple accounting system is used with these businesses which might include Quick Books, Xero, or other compatible bookkeeping/accounting system. The disadvantage of sole proprietorships is that it is exposed to legal liability with no limitation. The business of a sole proprietor itself does not pay income taxes. Profits and losses from the sole proprietor business flow through directly to the individual’s 1040 tax return on Schedule C and then taxed at the individual’s tax rate. However, it should be noted that profit reported on Schedule C is also subject to Self-Employment tax.

Sole proprietorships are the easiest business to form and operate. If a person does business under any name other than their true name, most states will require the filing of a fictitious business name which is known as a “Doing Business As” or a DBA Statement. These forms are available at the county recorder’s office as well as through some newspapers. There is no tax effect if a sole proprietor takes money out of their business, or transfers money to or from their business. However, it is a good idea to set up a draw account to help identify amounts that are not business but are for personal use.

Advantages of a Sole Proprietorship:

- All business tax advantages flow to the owner.

- Organizational costs are low.

- Legal & Accounting fees can be lower.

- State & Federal taxes may be lower.

- Administration is less complicated.

- Can be easily converted to another entity.

Disadvantages of a Sole Proprietorship:

- Personal liability.

- Inability to income split.

- Limited fringe benefits.

- Subject to Self-employment tax.

This covers the basic elements of sole proprietorships.

Partnerships

Partnerships can be defined as a relationship between two or more people (an individual, a corporation, a trust, an estate, or another partnership) who carry on a trade or business with each person in the relationship contributing money, property, labor or skill and with each expecting to share in the profits and losses of the business.

The partnership will be based on a partnership agreement together with any modifications and agreed to by each partner. The partnership agreement and any modifications can be either oral or written.

A partner’s share of income, gains, losses, deduction, or credits will typically be spelled out in the partnership agreement. The partnership agreement and any modification will be disregarded if the allocations to a partner under the agreement fail to have a substantial economic effect. An allocation will have a substantial economic if there is a reasonable possibility that the allocation will affect the dollar amount of a partners’ shares of partnership income or loss independently of tax consequences and the partner actually receives the economic benefit or bears the economic burden corresponding to the allocation.

Partnerships can have both general and limited partners. Limited partners are partners whose personal liability for the partnership is limited to the amount of money or other property they contributed to the partnership. Limited partners are not generally considered to materially participate in trade or business activities conducted through partnerships.

Limited partnerships can allow a sole proprietor to have part of his/her income from the business to be taxed in lower rather than the sole proprietor’s higher brackets. Family partnerships are a popular income-splitting concept by utilizing §704(e). One thing to note is that when the partnership is not recognized for tax purposes, the tax liability stays with the sole proprietor. Family members can contribute a capital interest in a partnership that can be withdrawn from the partnership or upon the liquidation of the partnership. The right to share in the earnings and profits is not a capital interest in the partnership. Family members in such partnerships can only include husband and wife, ancestors, lineal descendants, and any trust created for the benefit of such persons.

Advantages of partnerships include:

- Income is taxed to the partners rather than to the partnership.

- Distributed income is not subject to double taxation.

- Losses and credits will generally pass through to partners.

- The liability of limited partners is normally limited as in a corporation.

- There can be more than one class of partners.

- Partners can obtain basis for partnership liabilities.

- Special allocations are permitted.

- A partnership can be used to transfer value and income within a family group by making family members partners.

Disadvantages of a partnership include:

- The liability of general partners is not limited.

- Partners are taxed on earnings even if the earnings are not distributed.

- Partners cannot exclude certain tax favored fringe benefits from their taxable income.

- Partners may be required to file numerous state individual tax returns for multistate partnership businesses.

- In the absence of a business purpose, a partnership must use either a calendar year or the same year as the partners who own a majority of the interests in the partnership.

Limited Liability Companies

LLC’s are non-corporate businesses that provide its members with limited liability, a single tax, and the option to actively participate in the entity’s management. The IRS does not recognize an LLC as a distinct entity so for tax purposes the LLC may be treated as:

- A partnership,

- An association taxable as a corporation, or

- A trust.

While LLC’s have the corporate characteristics of limited liability, they are usually treated as a partnership for federal tax purposes since they can be organized without continuity of life, centralized management, or free transfer ability of interests.

When a limited liability company (LLC) is a partnership they include benefits such as the following:

- It provides the pass-through attributes provided under partnership tax rules;

- Limited liability to all members;

- It offers control membership control over the business without the risk that management participation will cost members their limited liability; and

- Provides freedom from S corporation eligibility requirements.

In addition, when an LLC holds assets with fair value in excess of basis, the availability of such an adjustment can be helpful by helping the transferring member to obtain a higher price for their interest. These situations are not available to shareholders of C corporations.

There are some non-tax benefits of LLCs which include:

- They can provide members with unique economic, voting, and other rights without creating a second class of stock.

- Rights of members can be modified by amending the LLC operating agreement which is not a publicly filed document.

- LLC members can be elected according to procedures set forth in the operating agreement.

- LLC members are not susceptible to piercing the corporate veil attacks solely as a consequence of the member’s failure to satisfy certain administrative formalities.

There are some disadvantages of LLCs which include:

- Uncertainty over self-employment taxes.

- They can be restricted to certain businesses and professions.

- In some instances, there can be additional taxes and filing fees.

- They are required to use the calendar method for accounting and taxes.

- A cancellation of indebtedness might stick to a member.

- There are issues with recourse and non-recourse debt.

- LLCs have no at-risk amounts because of the limited liability afforded to each member.

To sum up, LLCs are non-corporate businesses that provide members with limited liability, a single tax, and the option to participate actively in the entity’s management.

Corporations

There are two types of corporations, S corporations and C corporations. We’ll discuss both together with their advantages and disadvantages. First, it is important to point out the characteristics of a corporation which include:

- Associates (shareholders).

- An objective to carry on a business or profession and to divide the profits from the business.

- Continuity of life.

- Centralized management.

- Limited liability to the associates.

- Free transfer ability of interests.

C Corporations

C corporations have a number of tax advantages over S corporations and unincorporated businesses. First, C corporations can be used to split income between itself and its owners with potentially lower overall tax rates.

C corporations can deduct fringe benefits paid for its employees in contrast to S corporations who are not able to deduct these expenses for employees who are 2% or larger shareholder. Unincorporated businesses cannot deduct these payments for its owners. C corporations can elect a fiscal tax year whereas S corporations and partnerships must be on a fiscal year for the most part with some limited exceptions. Corporations are able to deduct up to 80% of the dividends they receive from investments in other domestic Corporations.

C corporations can have an unlimited number of owners and multiple classes of stock ownership. The owners of the shares are not restricted to being United States citizens or to the numbers of shareholders. Forming a corporation involves a transfer of money, property or both by prospective shareholders in exchange for capital stock in the corporation. When money is exchanged for stock, the shareholder or corporation realizes no gain or loss. The stock received by the shareholder has a basis equal to the money transferred to the corporation by the shareholder.

There are a number of complex restrictions associated with corporations which are beyond the scope of this post. The most significant issue is that C corporations are not allowed to use the cash basis of accounting and are required to use the accrual method. The accrual method requires that income needs to be reported when it is earned in contrast to the cash method of accounting used by sole proprietors, S corporations, qualifying partnerships, qualified personal service corporations, and small businesses with less than $5 million in gross receipts.

Because of the restrictions and complexity of C corporations, most small businesses and service companies will not use this method of business formation. These reasons when combined with the double taxation of earnings of C corporations will cause smaller entities to form as an S corporation, partnership, LLC, or as a sole proprietor.

S Corporations

Domestic corporations can avoid double taxation by electing to be treated as an S corporation allowing small business corporations to elect special rules under Subchapter S. The treatment allows S corporations to be treated similar to partnerships whereby income, deductions, credits, and gains and losses are passed through to shareholders on a pro rata basis. S corporations are taxed like a partnership in that it pays no taxes, and its income and deductions pass through to the shareholder.

Here are some of the advantages of S corporations:

- S corporations can distribute its profits to shareholders with only a single tax in sharp contrast to C corporations where a double tax is incurred because dividends are not deductible.

- Losses of S corporations are deductible by shareholders in contrast to C corporations where losses are not deductible by shareholders.

- A new corporation may elect S corporation status in its initial year of operation in order to utilize losses even though they may ultimately want to be taxed as a C corporation.

- An S corporation is exempted from the accrual method of accounting rules and can use the cash method of accounting.

- An S corporation provides a corporate shield for liability purposes for those who want the income and losses taxed to them, but do not want the potential liability problems of a partnership.

- S corporations can adopt tax deductible and non-deductible fringe benefit plans subject to special rules and limitation applicable to these plans.

- An interest deduction is allowed for funds borrowed by a shareholder to purchase stock in the S corporation and such interest constitutes business interest when the shareholder materially participates in the business.

- Many problems of C corporations such as alternative minimum taxes and personal holding taxes do not apply to S corporations.

There are some disadvantages associated with S corporations:

- Because there is no corporate tax rate it makes deferred compensation programs impractical.

- There is no opportunity to accumulate corporate earnings at a lower tax bracket which makes it difficult for S corporations to reinvest profits in the business.

- Split-dollar and other non-deductible fringe benefits for shareholders can’t be paid for by lower taxed corporate funds.

- The 80% dividend received deduction is lost.

- In some states, the S corporation election will not avoid the double tax.

- A new or dissident shareholder can cause termination of the Subchapter S election through a disqualified transfer of stock.

- S corporations lack the flexibility that partners, and partnerships have to equalize the outside basis of owner’s interest with the inside basis of the entity’s assets.

- All income, except long term capital gains, received by the corporation are taxable to shareholders.

- More record keeping may be required to maintain accurate records for basis in shareholders stock to maintain the accumulated adjustments account, and to determine the tax ability of distributions.

Becoming an S Corporation

In order to become an S corporation, it must be formed in accordance with both state and federal laws. The corporate capitalization involves the transfer of money and/or property to the corporation in return for stock. The corporation must meet the requirements of S corporation status and all shareholders must consent to the S corporation status. The corporation will utilize a tax year status unless it meets special requirement to select another tax year and it will have to file Form 2553, Election by a Small Business Corporation, to indicate that it chooses S corporation status.

S corporation status is only permitted to “small business corporations.” S corporations are limited to a maximum of 100 shareholders who are U.S. citizens and non-resident aliens are prohibited from being shareholders. While this is the primary rule, resident aliens who possess a green card could be a shareholder, but this puts the corporation in jeopardy should this status change after achieving S corporation status. The requirement is to have only individuals as shareholders who are advised to establish a buy-sell agreement that restricts transfers to ineligible persons.

There are some special situations that allow estates and certain trusts to be a shareholder. In these instances, it is essential that the laws and regulations be carefully followed so as to not jeopardize the sub-chapter S status of the organization. Non-resident aliens may not be S corporation shareholders. In addition, a C corporation is not allowed to be a shareholder in an S corporation.

There you have the basics of business entities.